Stay in Touch

Get sneak previews of special offers & upcoming events delivered to your inbox.

Sign in

09-10-2016 07:07 AM

The following is from The Economist

http://www.economist.com/node/21706561/print

Fashion retailing Passé

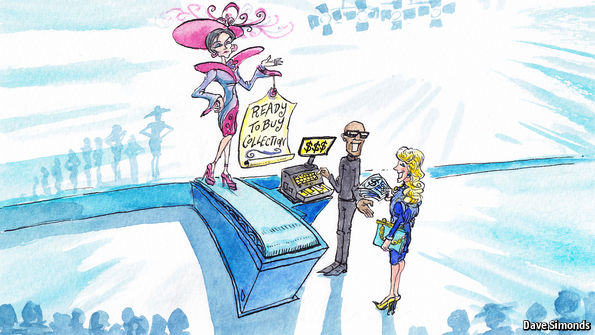

The fashion industry grapples with bad timing

Sep 10th 2016 | From the print edition

NEW YORK CITY has just begun its sacred rites of retail. For its fashion week, which started on September 7th, tents go up, guests emerge from black cars, models sulk down catwalks and the wealthy and celebrated clap in unison. The point of all this is for designers to declare what will be “in” next spring. But for much of fashion retail, it is increasingly clear that something is out of place.

For a sense of the problem, consider what happens when the week-long schedule of shows ends. Designers start making the clothes that retailers have ordered, with delivery scheduled four to six months later. But consumers see collections online instantly. “Fast fashion” shops such as Zara, which is part of Spain’s Inditex, rapidly produce clothes “inspired” by what appeared on the runway. When the originals arrive in stores, they feel tired.

This has produced clear winners and losers. The world’s two biggest clothes retailers are now Inditex and TJX, according to Euromonitor, a research firm. TJX buys excess inventory of brand-name clothes and resells them at low prices. Traditional department stores, meanwhile, are struggling, partly because outdated frocks and coats languish on racks and then have to be sold at a discount.

The challenge is widely understood. Now the industry is finally starting to deal with it. In March the Council of Fashion Designers of America (CFDA) and the Boston Consulting Group suggested alternatives to the current, slow retail cycle, some of which have been championed by fashionistas. A small band of designers are testing new business models this week in New York, or plan to at fashion week in London later in the month. The idea is to show clothes and sell them at the same time. It may seem obvious, but the shift is not easy for designers, suppliers, fashion magazines and retailers that have worked for so long around the old calendar. Most designers are sticking to it, with minor adjustments. During February’s fashion week in New York, for example, Michael Kors and Tory Burch showed only a very few looks that were available immediately.

Others are going further. On September 7th Tom Ford staged not a “spring” runway show, as is customary, but a party streamed live online, featuring clothes from his autumn 2016 collection that are available for sale now. Rebecca Minkoff, another designer, will present her collection on the street outside her Manhattan store, with guests invited to shop for the runway looks immediately. Because retailers have already decided which of its clothes to stock, the fashion show can promote specific items to boost their sales. It becomes a more closely co-ordinated activity, says Uri Minkoff, the company’s chief executive.

British designers are adapting, too. Burberry’s show in September will for the first time present only clothes that are available immediately. The company has pulled its entire fashion-design process forward by about six months, with clothes conceived, samples produced and presentations to editors and retailers all concluded much earlier. The catwalk event will not be a business event for the garment trade but a marketing event for consumers.

But old habits die hard. The CFDA is exploring whether retailers might stock more clothes when people like wearing them. But many stores and designers still expect them to buy fur coats in July. And some in the industry are sceptical. Pascal Morand, who oversees Paris’s fashion week, approves of selling clothes that consumers can wear now. But he also worries about designers listening too much to what people want. “Consumers favour incremental innovation,” he says, whereas the most exciting designs defy the norm and are often adopted by consumers only gradually.

09-10-2016 07:17 AM - edited 09-11-2016 09:28 AM

How about addressing the fact that with outsourcing to third world countries, manufacturers have decided that shoddy construction and flimsy fabrics are a real turn-off to consumers. Most of us aren't about to buy couture designs or even the ready-to-wear garments of top designers ( I love when they tell us that you can buy a piece of clothing for "only" $900). That doesn't mean that we should be satisfied with clothes that look like they've been worn to death before you buy them.

09-10-2016 07:52 AM

Newsday has been running daily reviews of NYC Fashion Week complete with fairly large color pictures (5 to 6 a day). Designers and retailers need to do more than sell immediately to get me back to buying. Of the first twelve pictures, there was nothing I would ever consider wearing even toned down to sell to the general public. In fact, there was very little I'd even like to see on any of my nieces and grandnieces all of whom are tall and slim and love fashion.

What is scary to me is that brick and mortar shopping becomes harder and harder - and for those of us with bodies that don't really fit into one of the mass-market forms, it's tough. .

09-10-2016 08:12 AM - edited 09-10-2016 08:17 AM

The fashion industry must promote itself. The Runway seems to be the tradition. I watch with a chuckle. My five foot curvy little body (that changes sizes each season) would never be able to make an attempt at wearing any of it. I cannot ever be tall, and what looks like starved to death just to wear these things. And the colors of the season, maybe, but not likely. I know what looks good on me and what doesn't and believe me I am willing to try it all out just to see. I have closets full of variety after variety of clothing choices.

The shopping channels translate the latest and greatest, by color and design and let us know in no uncertain terms what is Now In.

As for me I shop sales, online, and on shopping channels. Most of my hard earned dollars go to Amazon, and Walmart and Blair. As for the Q I watch for AS IS or Clearance, or Last Clicks. I even like the new Zulily (under the watchful eye of QVC). Zulily is very modern and inexpensive. I NEVER GO INTO A STORE, DOES NOT FIT, NEVER FIT. Therefore the new styles filter down to the better price point if anyone is willing to wait a day or so.

What I am trying to say is the fashion industry needs to be NOW, FRONT AND CENTER. They need to adjust to the information age where everything is in an instant. This will be quite a task. In any case by the time they have it all down, my wardrobe is done. I can only imagine I am not alone.

09-10-2016 11:04 AM

Few of us can identify with the high fashion models on the runway but it's not just about some of the outrageous styles. It's about fabrics, colors, combinations of both.

What are trends? Skirts vs. trousers, knits vs. woven. This color or that. While I can never picture myself in the garment, I do look at the elements.

But the "rag" business did this to themselves, the industry will re-set and roar back. I think the remainder of 2016 will be flat but I have high hopes for 2017.

09-10-2016 11:27 AM

Tim Gunn has a wonderful article about the fashion industry leaving shoppers a size 12 or above in the dust. There is bias out there.

09-10-2016 01:50 PM

Luxury brands are taking a hit due to the economic and political conditions around the world which is why they are trying anything to stay relevant and that includes turfing out their creative directors. It's musical chairs when their financials drop.

The "see now, buy now" business model that some luxury brands are going to implement is designed to cut the legs off of fast fashion retailers. Will it work? That remains to be seen.

Get sneak previews of special offers & upcoming events delivered to your inbox.

*You're signing up to receive QVC promotional email.

Find recent orders, do a return or exchange, create a Wish List & more.

Privacy StatementGeneral Terms of Use

QVC is not responsible for the availability, content, security, policies, or practices of the above referenced third-party linked sites nor liable for statements, claims, opinions, or representations contained therein. QVC's Privacy Statement does not apply to these third-party web sites.

© 1995-2024 QVC, Inc. All rights reserved. | QVC, Q and the Q logo are registered service marks of ER Marks, Inc. 888-345-5788